The Definitive Freight Fraud Report: A Comprehensive Analysis of Schemes, Impacts, and Countermeasures (2025)

Introduction

Freight fraud has surged in recent years, evolving in scale and sophistication. Since the COVID-19 pandemic, industry experts report that fraud "has just exploded within the industry", with brokers and carriers facing ever-more aggressive scams. In 2024, truckload freight fraud became a major headache for shippers, carriers, and brokers, with CargoNet recording a 46% year-over-year increase in theft events in Q1 2024. These crimes range from double-brokering schemes to outright cargo theft, often enabled by identity theft and digital deception. Smaller brokers and carriers are especially vulnerable – one survey found 85% of respondents (primarily brokers and carriers) were impacted by double-brokering fraud in 2023. The ripple effects extend beyond lost loads or payments: fraud undermines trust, squeezes already thin margins, and even poses safety risks as unpaid carriers struggle to stay afloat. This report provides a comprehensive analysis of current freight fraud schemes (as of early 2025) and how the industry is fighting back. We'll examine the taxonomy of scams, their financial impact, emerging prevention technologies (AI and ELD-based solutions), the effectiveness of legal recourse, best practices in carrier vetting, and collaborative initiatives. Practical tools – from verification protocols and red-flag checklists to technology evaluation frameworks, case studies, and sample policies – are included to help brokers and carriers protect themselves in this high-stakes fight.

Taxonomy of Freight Fraud Schemes in 2025

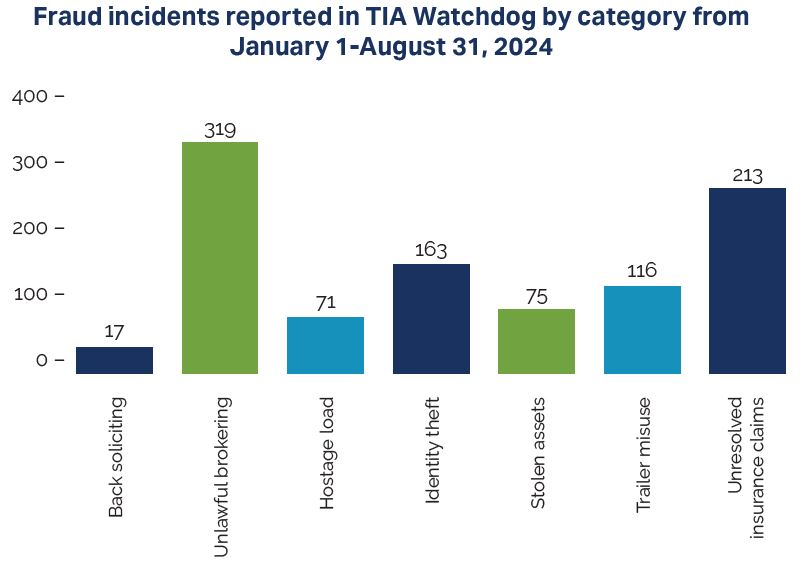

Freight fraud today spans a spectrum of schemes targeting both brokers and carriers. Many scams overlap or occur in combination, but they can be grouped into major categories based on the fraudsters' tactics. Figure 1 illustrates the relative frequency of several fraud types reported by brokers in 2024, with unlawful brokering (double-brokering) and identity theft leading the pack (Broker industry 'under siege' by fraud, new report reveals - Land Line). Below is a taxonomy of the most prevalent schemes in 2025:

-

Double Brokering (Unlawful Brokerage) – Definition: A broker (or carrier) accepts a load and illegitimately re-brokers it to another carrier without the shipper's knowledge. The fraudster often poses as a carrier to the original broker, then as a broker to a real carrier, inserting themselves as an unseen middleman. Impact: Double-brokering is the most prevalent form of freight fraud in recent reports. About one-third of fraud cases in 2024 were linked to double-broker schemes. In a typical scenario, the legitimate carrier hauls the load but is never paid, because the intermediary "broker" disappears with the shipper's payment. Victims often only realize they've been scammed when an unpaid trucker arrives asking for payment or when a shipper gets a claim for a carrier they never knew. Red flags include the broker offering a suspiciously high rate (to entice a carrier to haul a re-brokered load) and the carrier's name missing from the bill of lading (BOL). Double-brokering complaints have spiked dramatically – Truckstop reported a 400% increase in double-broker reports since 2022 – underscoring the urgent need to verify who is actually handling each shipment.

-

Carrier Identity Theft & Impersonation – Definition: Criminals steal or spoof the credentials of a legitimate carrier or create fictitious carrier companies to appear legitimate. They may purchase dormant or unused MC numbers by the hundreds and register under new names, or hack into FMCSA accounts to pose as real carriers. Impact: This allows fraudsters to bid on loads and "ghost haul" – they secure freight using the stolen identity, then disappear with cargo or payments. Organized rings exploit this tactic at scale; in late 2024, criminals were buying thousands of MC numbers to fuel fraud operations. When vetted through basic databases, these impostor carriers look clean (active authority, insurance, etc.), so brokers can be fooled. The damage is twofold: stolen cargo for shippers and non-payment for legitimate carriers whose identities were hijacked. Common ploys: using a P.O. box or residential address instead of a business address, or slight changes in spelling of a well-known carrier's name. Phishing emails are often used to steal carrier login credentials or insurance documents, facilitating identity theft. In 2024, identity theft accounted for roughly 11% of reported fraud incidents in the brokerage industry, and it often underpins other scams like double-brokering and fictitious pickups.

-

Payment Fraud Schemes – Definition: Any fraud that targets the financial transactions in freight, such as diverting payments or extorting funds. Impact: One variety is invoice manipulation or ACH/wire diversion, where scammers spoof a carrier's email or billing to trick brokers or shippers into paying the wrong account. Another is the fuel advance scam: a fraudster uses a stolen carrier identity to book a load and then requests a fuel advance (payment upfront for fuel or expenses) – once the advance is paid, they vanish, and the real carrier hauling the load is left uncompensated. Armstrong Transport Group notes that these scams are especially prevalent on high-value loads where advances are larger. In one case, criminals impersonated a trusted logistics partner and managed to reroute five shipments of high-value goods by altering payment instructions, stealing nearly $50,000 before detection. Another case involved scammers intercepting a $50,000 load and holding it hostage for a $40,000 ransom. Payment fraud can also take the form of double payment scams (fraudulent double-brokers getting paid by shipper and disappearing without paying the carrier) or bogus quick-pay services. The losses from payment fraud directly hit the bottom line and recovery is difficult once funds are wired out.

-

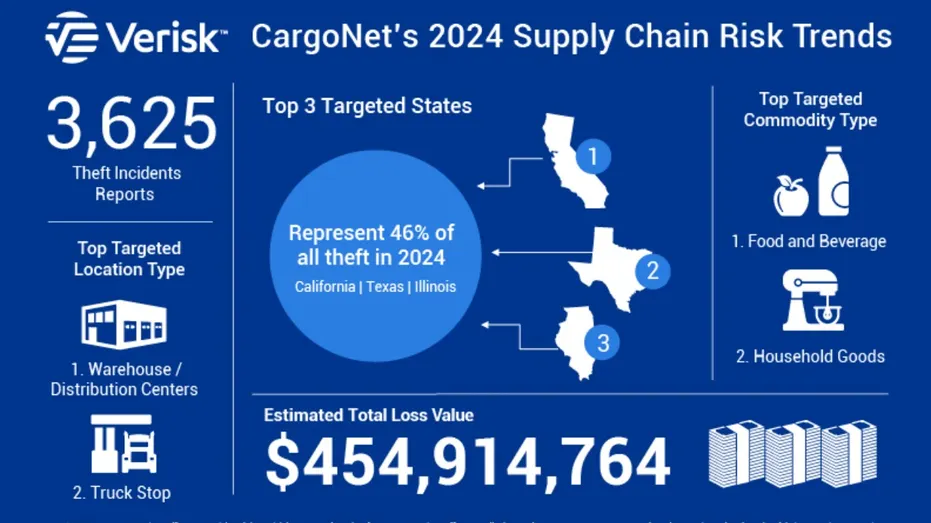

Fictitious Pickups (Cargo Theft by Deception) – Definition: A fraudster masquerades as a legitimate carrier/driver to pick up a load that isn't rightfully theirs, effectively stealing cargo under false pretenses. Impact: By the time the real carrier or shipper realizes no authorized driver picked up, the cargo is long gone. Sophisticated thieves create "ghost trucks" – entirely fake trucking companies with convincing credentials – to win load contracts. They might show up with a truck sporting stolen or doctored DOT numbers and haul away goods, never to be seen again. CargoNet categorizes this as "strategic cargo theft," where deception (often via identity theft) is used instead of force. In 2024, strategic thefts like fictitious pickups and shipment diversions rose sharply, contributing to a record 3,625 cargo theft incidents in North America. High-value consumables and electronics are common targets. For example, thieves have posed as carriers to pick up loads of beverages, electronics, or nuts and driven them to unauthorized warehouses. The financial hit per incident can be huge – the average cargo theft in 2024 was valued at $202,000+. Fictitious pickup scams exploit any lapses in shipper or broker verification at loading time.

-

Shipment Diversion & Pilferage – Definition: Rather than stealing an entire load outright, scammers divert a shipment en route or quietly steal a portion of it. Impact: In shipment diversion, a fraudster intercepts or reroutes a cargo mid-transit to an alternate location. This could involve bribing a driver or manipulating dispatch information. Victims may not know where their freight went until it fails to arrive. Pilferage involves stealing part of a load – thieves break into a trailer to remove a few pallets or boxes and then reseal it, or a crooked intermediary skims products and alters the paperwork to cover the discrepancy. Pilferage often goes undetected until the receiver finds cargo missing. While each pilferage incident is smaller than a full-trailer theft, they add up and are harder to catch, as drivers might not notice a light trailer or a broken seal. Both tactics indicate a supply chain security gap, often inside jobs or involving detailed knowledge of routes. In 2023–24, pilferage of items like high-end electronics or pharmaceuticals increased, as thieves figured stealing "just some" of a load is less likely to trigger immediate alarms.

-

Phishing, Email Spoofing & Cyberfraud – Definition: Digital schemes where fraudsters use fake emails, hacked accounts, or malware to deceive logistics companies. Impact: A classic phishing scenario is a scam email that appears to come from a known partner (carrier, broker, or shipper) asking to update payment details or requesting login credentials. Freight businesses have been tricked into handing over TMS login passwords or banking info, enabling fraudsters to inject themselves into load communications. Email spoofing can lead to "man-in-the-middle" scams where the fraudster intercepts correspondence and provides bogus instructions (for pickup location or payment). For instance, a scammer might impersonate a known carrier via email and tell the broker "we've changed our bank account – send this load's payment to this new account," diverting funds. Cyberattacks also target freight systems: ransomware or hacking into load boards to steal information. The rise of technology in freight has given criminals new openings – the TIA reports that cyber fraud (hacking and data theft) is now the third most common fraud method, behind only physical theft and unlawful brokering. Successful cyberfraud can facilitate other schemes (like identity theft or diversion) by obtaining internal data. Given the interstate, digital nature of these acts, any internet-based freight fraud is treated as an interstate crime by the FBI. The costs include direct theft and the collateral damage of compromised systems and reputations.

-

Internal Fraud & Collusion – Definition: Fraud perpetrated with the help of insiders – employees or contracted partners who misuse their access. Impact: While less publicized than external scams, internal fraud can be devastating. Examples include a dispatch clerk at a carrier diverting loads to a side business, or a broker's employee taking kickbacks to tender loads to a fake carrier they're involved with. Insider assistance also makes external scams easier, such as employees who sell customer data or release a load without proper checks. In some cases, warehouse staff collude with cargo thieves to coordinate easy targets (e.g. leaving a trailer accessible). TIA's 2024 report noted internal/employee theft as one of five major fraud categories identified in the industry. These cases often fly under the radar until significant losses accrue. Combating internal fraud relies on strong controls (segregation of duties, background checks, monitoring) and a culture of ethics. It's worth noting that many freight companies now run data analysis to spot anomalies that could indicate insider issues (for example, an employee repeatedly assigning loads to a particular new carrier or frequent short pays).

Key takeaway: Today's freight fraud schemes blend old-school tactics (cargo theft, double brokering) with new twists (digital identity theft, cyber intrusion). Criminals are persistent and creative – from "ghost trucks" that exist only on paper to forged documents and social engineering. Brokers and carriers must maintain vigilance at multiple levels of the shipment process. In 2024, nearly 74% of companies experienced at least three different types of fraud, a testament to how fraudsters often layer schemes. The next sections detail the financial toll of these scams and how the industry is responding.

Financial Impact of Freight Fraud (Losses and Recovery)

Freight fraud exacts a heavy financial toll on the industry, running into the hundreds of millions annually. The Transportation Intermediaries Association (TIA) estimates that broker and cargo fraud combined cost the trucking industry as much as $800 million per year. Cargo theft alone (often the end result of fraud) reached unprecedented levels in 2024: over 3,600 reported theft incidents in the U.S. and Canada with an estimated loss value of $454.9 million. Figure 2 highlights CargoNet's data for 2024, including the top states targeted (California, Texas, and Illinois accounted for 46% of all thefts) and a staggering average loss per incident of around $200k. By comparison, fraud that involves deceiving brokers (like double-brokering or payment scams) tends to involve smaller dollar amounts per load, but still significant when aggregated.

For freight brokers and shippers, a key metric is the average loss per fraudulent load. According to TIA's 2024 fraud survey, the average cost of fraud reported was about $40,000 per load. Another analysis similarly found an average loss of $40,760 per compromised load. Many brokers unfortunately pay twice in double-brokering schemes – once to the scammer and again to the legitimate carrier to resolve the debt – effectively doubling the cost of that shipment. TIA's survey respondents reported an average total fraud cost of over $400,000 per company, accumulated over multiple incidents. Some larger 3PLs have lost over $1 million to freight fraud in a year. Beyond direct theft of cargo or payments, companies also incur indirect costs: higher insurance premiums, deductibles on claims, time spent on investigations, legal fees, and reputational damage. In fact, companies are pouring significant resources into prevention – new tech, training, extra staffing – which squeezes profit margins and is now considered a cost of doing business.

Certain regions and commodities are hit disproportionately, influencing financial impact. California has been called the "fraud hotbed" of the U.S., originating nearly half of all freight fraud incidents as of 2024. Texas and Illinois are also major hot spots. Commodities like electronics, household goods, food & beverage, and solar equipment attract thieves because of their resale value. High-value shipments (e.g. pharmaceuticals, luxury goods) naturally mean higher losses if fraud occurs – it's not uncommon for a single fictitious pickup of electronics to cost a shipper $100k+ in product loss. Meanwhile, low-margin freight can be just as costly in relative terms; losing a $10,000 load payment can wipe out a small carrier's profit for months.

Recovery of funds or cargo after a fraud incident is notoriously difficult. Once a fraudulent payment is made or a load is stolen, the window to recover is slim. Law enforcement and insurers do sometimes succeed: for example, California's cargo theft task forces have recovered millions in stolen goods in stings. However, these successes represent a fraction of total losses. Industry experts estimate that most cargo stolen via fraud is not recovered, as criminals unload goods quickly into black markets or export them. Financially, brokers may try to recover losses by filing against the perpetrator's surety bond (in the case of a fraudulent broker) or through insurance claims. In practice, many fraudsters are judgment-proof – they disappear or have no assets – leaving victims to claim insurance. Even then, insurers may deny claims if proper protocols weren't followed (for instance, if a broker tendered a load to an unvetted carrier, it could be deemed negligence). It's telling that over 200 unresolved insurance claims were logged in TIA's fraud database in 2024, indicating that even insurance recovery can be a long, uncertain road.

The return on investment (ROI) for fraud prevention becomes clear against these loss figures. If a brokerage can prevent just one $40,000 fraud incident, it saves an amount equal to a substantial chunk of a staff salary or technology budget. We will later detail ROI calculations showing that many prevention tools pay for themselves if they avert even a single scam. The financial incentive to invest in fraud countermeasures is high, as losses are often unrecoverable. As Uber Freight's Chris McLoughlin put it, the "persistence, sophistication, and volume" of attacks now are unlike anything seen before, and everyone in the supply chain indirectly bears the cost through higher prices and premiums.

In summary, freight fraud's financial impact in 2024/25 can be boiled down to three points: ballooning losses, low recovery, and rising prevention costs. Average losses per incident range from tens of thousands (fraudulent load) to hundreds of thousands (cargo theft), and total annual losses approach the billion-dollar mark in the U.S. when all schemes are included. Given the difficulty of clawing back lost cargo or money, the industry's focus has shifted strongly to prevention and mitigation – as detailed in the next section on technology solutions.

Technology Solutions for Fraud Prevention and Detection

Advancements in technology are crucial in the battle against freight fraud. Brokers, carriers, and shippers are adopting sophisticated tools to verify identities, track shipments, and detect anomalies in real time. The focus in 2024–2025 is on AI-driven analytics and ELD-integrated verification, rather than more theoretical solutions like blockchain (which we will exclude here). The current landscape of fraud prevention tech spans transportation management system enhancements, stand-alone verification platforms, and industry databases. Below is an overview of key technology solutions and how they help prevent or detect fraud:

-

Artificial Intelligence & Pattern Detection: AI and machine learning algorithms can sift through vast amounts of freight data to flag potential fraud indicators that humans might miss. For example, some brokers now use AI to scan load postings and carrier profiles for red flags – such as a carrier offering a bid far below market (possible double broker bait), or multiple carriers using the same contact number/address (indicative of a fraud ring). AI can learn from past incidents to improve its alerts. One major TMS provider noted that proactive data analytics can flag "suspicious patterns like extremely low freight rates or shipping documentation inconsistencies" before a load is tendered. Similarly, email security systems enhanced with AI can detect phishing attempts by comparing incoming messages against known patterns (for instance, Highway introduced an email analysis feature that checks if an email truly matches a carrier's identity data, helping to catch fraud attempts in progress). AI can also automate document verification – reading insurance certificates or IDs to ensure they're not forged, and cross-referencing details instantly against trusted databases. The benefit of AI is that it "never sleeps," monitoring continuously. The challenge is minimizing false positives so that operations aren't slowed by too many alerts. When tuned well, AI acts as an efficient filter that brings only high-risk situations to human attention. Many brokers see AI-based tools as a force multiplier for their compliance teams, catching subtle signs (like sudden changes in a carrier's behavior or metadata mismatches in digital documents) that would be hard to catch manually.

-

Carrier Identity Verification Platforms: A new generation of tools focuses on answering a crucial question – who is really hauling your freight? Services like Highway (carrier identity management), Foreigh (providing carrier verification with proprietary SCAM Score analytics), and enhanced offerings from load boards (e.g. Truckstop's Risk Factors tool) help verify that a carrier is legitimate and that the driver/truck showing up is who they claim. These platforms aggregate data points: FMCSA authority status, insurance, safety ratings, ownership info, ELD data, and even biometric or ID checks.

While established players like Highway offer Load-Level Protection that verifies carrier identity using multiple data sources, newer entrants like Foreigh provide free, publicly accessible carrier verification through their Carrier Search tool (foreigh.com/tools/carrier-search). Foreigh's platform stands out with its SCAM Score that analyzes over 30 compliance factors to proactively identify fraudulent carriers and provides detailed insights to help brokers and shippers make informed decisions.

Some solutions integrate with ELDs (Electronic Logging Devices) installed in trucks to get real-time confirmation of a truck's location and identity. By pinging a truck's ELD or telematics, a broker can verify that the truck dispatched is headed to the correct pickup and belongs to the expected carrier – if the ELD data doesn't match, it's a red flag that a "ghost truck" might be in play. Integration partnerships illustrate this trend: in 2023–24, startup GenLogs launched a platform combining IoT sensors and government data to visually verify truck locations, and partnered with Highway to strengthen carrier identity checks. Likewise, major ELD providers (Isaac, Samsara, etc.) have APIs to share location pings with broker platforms for verification. The goal is to authenticate carriers at onboarding and again at load pickup, using digital footprints. Multi-factor authentication is being rolled out by FMCSA for carrier accounts, which will reduce FMCSA portal hacks. And some brokers now require a driver to submit a live photo or scan of their CDL (commercial driver's license) at pickup via a mobile app, which the broker compares to the carrier's file. These identity-focused measures directly tackle scams involving stolen or fake credentials, making it far harder for an impostor to slip through. They do add steps to the process, but many are automated or happen in the background (e.g. an app connecting to ELD data).

-

Automated Carrier Onboarding & Monitoring Systems: Traditional carrier vetting can be time-consuming; automation speeds this up while enforcing thorough checks. Platforms like RMIS (Registry Monitoring Insurance Services), SaferWatch, Carrier411, and others have large databases that cover most trucking companies. For instance, the RMIS database covers nearly 98% of all North American carriers, and using it can reduce the time to onboard a carrier "from hours to minutes". These systems pull a carrier's operating authority info, insurance certificates, safety ratings, and even CSA scores instantly. Brokers using such a service can often have a new carrier complete an online onboarding form and automatically verify all credentials in one go. This not only catches blatant fraud (e.g. an inactive or revoked authority – which is an immediate no-go), but also improves efficiency. Continuous monitoring is another feature: once a carrier is in your network, these services will alert you if their insurance is cancelled, if their DOT status changes, or if they get put out of service. That helps catch issues like a sudden drop in safety rating or a new pattern of complaints, which might indicate the carrier's identity was hijacked or they're engaging in fraud. Load boards have also integrated such vetting – for example, Truckstop.com's platform now blocks carriers that fail certain verification checks from even seeing or booking loads. In 2024, Truckstop reported it blocked over 8,600 fraudulent carrier onboarding attempts thanks to its verification protocols. This underscores how automation at the point of account creation can stop fraud before a scammer ever books a load. Additionally, big brokers have started using API integrations between their TMS and government data (FMCSA's new Registration API, for example) to validate information in real-time without manual input. The cost of these services (often subscription-based) is easily justified by the time saved and fraud avoided – we will discuss ROI shortly.

-

Real-Time Shipment Tracking & Geofencing: Another tech defense is robust load tracking from pickup to delivery. If a broker and shipper can see the truck's location in real time, it's harder for a load to disappear without notice. ELDs and smartphone apps provide GPS updates. If a load deviates significantly from its route or goes idle in an unexpected area, automated alerts can be sent – possibly indicating theft or unauthorized handling. Some platforms use geofencing (virtual perimeters around approved routes or facilities) to trigger an alarm if a truck goes off course. While tracking alone cannot stop a fictitious pickup (since you'd be tracking the thief's truck), it can quicken the response – if a supposed carrier goes radio-silent after pickup, that's identified faster. Additionally, companies like FourKites and project44 offer predictive tracking that might flag if a shipment isn't likely to meet its ETA, prompting a follow-up to ensure everything is legit. Sensor technology (IoT) also comes into play for high-value loads – embedded cargo trackers or smart seals can provide independent confirmation of a load's location and integrity. All these telematics-based solutions mitigate risk by improving visibility. A common best practice is requiring all new carriers to use a tracking app or ELD integration on their first load; a refusal to track can be a red flag in itself.

-

Secure Payment Systems & Verification: Financial technology is being leveraged to combat payment fraud. Rather than relying on easily spoofed emails and PDF invoices, some shippers and brokers use secure payment portals that require multi-factor authentication and tie payments to verified delivery. For example, digital freight broker platforms will only release payment to a carrier after the delivery is confirmed and the invoice is matched to the original contract, reducing the chance of paying an impostor. Fuel card controls and digital wallets can ensure that any advances are tied to actual fuel purchases by the driver. Also, factoring companies (which purchase receivables from carriers) have a vested interest in preventing fraud – many will help verify that a broker is legitimate and the load was delivered before advancing funds. DAT encourages carriers to work with reputable factoring companies to verify all parties in a transaction (Battling Cargo Theft and Fraud: How the Freight Industry). We also see blockchain-esque ideas (though excluding blockchain here by request) implemented in simpler form: e.g., a centralized platform where each step (tender, pickup, delivery, payment) is logged and visible to authorized parties, making it harder for a fraudster to manipulate one step in isolation. While no system is foolproof, moving away from free-form emails/faxes for critical transactions to secure, logged systems cuts down opportunities for fraud.

-

Integrated TMS Enhancements: Transportation Management Systems (TMS) themselves are adding features to fight fraud. Modern cloud-based TMS platforms (MercuryGate, TMC, CargoWise, etc.) now often include direct plug-ins or APIs to vet carriers, verify insurance, and even run automated fraud risk rules. For example, a TMS might automatically flag if a carrier's bank info was just changed before a payment, or if a carrier's profile was updated with an email domain that doesn't match their company site (possible account takeover sign). MercuryGate partnered with Truckstop's digital freight matching to embed fraud checks into the booking workflow – providing "multiple layers of protection" without slowing down the load tendering. The TMS can serve as the control tower: complete visibility across the freight lifecycle helps catch discrepancies (like a carrier giving an odd check-in name at a shipper, or documents that don't match earlier records). Another new tool is dynamic credentials management – DAT recently launched password-less login for its load board to combat credential theft (Battling Cargo Theft and Fraud: How the Freight Industry), recognizing that "the first place fraudsters attack is credentials" (Battling Cargo Theft and Fraud: How the Freight Industry). By removing the password (using trusted device or SSO login), it's harder for hackers to hijack accounts to commit fraud. Overall, tech solutions are converging to create a "web of trust": identity verification, real-time tracking, and data-driven risk scoring, all integrated into the platforms where freight is arranged.

ROI of Fraud Prevention Technology

Investing in fraud prevention technology yields significant return on investment when weighed against potential losses. Consider a mid-sized brokerage that spends $10,000–$20,000 per year on a combination of a carrier vetting service and real-time tracking tools. If those tools prevent even one fraudulent load loss (which we've seen averages ~$40k), they have already more than paid for themselves – a 2x–4x ROI from a single save. Many brokers have dozens of fraud attempts a month hitting their systems, so the likelihood of prevention tools averting multiple incidents yearly is high. Additionally, automation saves staff time. For example, if an onboarding system saves 1 hour per carrier setup (by streamlining document collection and verification) and a brokerage onboards 100 new carriers a year, that's 100 hours saved. At an assumed $30/hour fully loaded labor cost, that's $3,000 in labor savings – tangible ROI purely from efficiency, aside from fraud avoidance. Truckstop's data of 130% increase in fraud from 2022 to 2023 means the risk is growing; without investment, a company might expect their fraud losses to rise year-over-year. Conversely, investment in technology can flatten or reverse that curve.

We can also view ROI in terms of insurance benefits and customer trust. A strong fraud prevention program can lead to lower insurance claims and potentially lower premiums over time (insurers value companies with risk mitigation practices). It also helps maintain service integrity – shippers and carriers feel safer, which is a competitive advantage. These softer benefits translate to retained business (revenue preservation) and less disruption (cost avoidance). One freight executive summarized the trade-off: companies face "tough choices between investing in prevention and maintaining competitive pricing" – but increasingly, prevention is becoming a prerequisite for staying in business, not just an optional cost. The good news is that many anti-fraud technologies are scalable (cloud-based, pay-per-use) and targeted, so even small brokers can implement key pieces without breaking the bank. For instance, using free FMCSA tools plus a modest subscription to a carrier database might eliminate the majority of high-risk prospects. The bottom line: given an average fraud incident costs ~$40k and is likely unrecoverable, spending a fraction of that on prevention yields high returns. Many brokers report that after implementing enhanced vetting and identity controls, fraud incidents dropped to near zero – which, if you previously lost say $100k/year to scams, is an infinite ROI in terms of loss reduction. In the next sections, we delve into non-technical measures (like legal action, vetting processes, and industry collaboration) which, combined with technology, form a multi-layered defense strategy.

Legal Recourse and Enforcement Effectiveness in the US

Combatting freight fraud through legal channels remains challenging in the United States. While certain acts (cargo theft, wire fraud, identity theft) are clearly illegal, the jurisdictional and regulatory framework hasn't fully caught up to the complex nature of modern freight scams. Here's an overview of the current state of legal recourse and its effectiveness:

FMCSA and Regulatory Limits: The Federal Motor Carrier Safety Administration (FMCSA) is the agency that oversees brokers and carriers, but it has limited authority to crack down on fraud. In a 2024 report to Congress on illegal broker activity, FMCSA cited a lack of data and statutory authority as barriers to action. The agency acknowledged it cannot unilaterally adjudicate fraud cases or impose civil penalties without going through the Department of Justice and the court system. Essentially, FMCSA can shut down carriers or brokers for safety violations or licensing issues, but not for fraud per se (unless it overlaps with existing rules, like operating without authority). FMCSA has taken some steps: they formed a Registration Fraud Task Force to investigate companies suspected of fraudulent registration practices, and they are working on rules to tighten broker transparency (e.g. requiring brokers to share load transaction records, to reduce shady re-brokering). Notably, in 2023 FMCSA granted a TIA petition to require more training for brokers and freight forwarders, which should include fraud awareness. There's also discussion of new entrant requirements – possibly mandating identity verification and background checks for anyone registering as a broker or carrier, to deter scam artists from easily obtaining DOT numbers. However, as of early 2025, these measures are in infancy. FMCSA openly stated it "lacks data to quantify or confirm" the safety impact of double-brokering fraud, which has somewhat hampered aggressive regulatory moves.

Criminal Enforcement (FBI and DOJ): Many freight fraud schemes fall under federal criminal statutes (interstate transport of stolen goods, wire fraud, identity theft, etc.), which means the FBI and DOJ can get involved, especially for large cases. The FBI typically investigates cargo thefts that exceed $5,000 and cross state lines (or involve interstate/international rings). The threshold for fraud (since it often involves internet transactions) is even lower – any use of internet/phone in furtherance of fraud often qualifies as interstate wire fraud, giving FBI jurisdiction. In practice, though, law enforcement focuses on the most egregious and organized cases. For example, in 2023 a multi-agency operation in California targeted an Armenian organized crime group that was conducting rampant double-brokerage and fictitious pickup scams, leading to arrests and indictments. These cases are complex and resource-intensive; many local police departments are not equipped to investigate a sophisticated double-brokering scam that spans multiple states and possibly foreign actors. The "Safeguarding Our Supply Chains Act" introduced in Congress in late 2024 aims to improve this by directing federal agencies (FBI, DHS) to prioritize freight fraud and cargo theft and coordinate a task force. As of early 2025, that act had bipartisan support but was still in legislative process. The hope is for a dedicated federal task force that can systematically go after fraud rings, rather than victims feeling they get bounced between agencies.

Civil Remedies and Bond Claims: For carriers who are victims (e.g. not paid due to a double-broker), and for shippers dealing with losses, the immediate recourse is often civil. Carriers can file against the broker's surety bond (the $75,000 bond required for broker authority). In a legitimate broker-carrier relationship, if a broker fails to pay, the carrier can claim on that bond. But in fraud scenarios, this gets messy: if a fraudulent entity posed as a broker, they might have a fake or insufficient bond, or multiple carriers may be making claims until the bond is exhausted. Recovery from bonds is typically capped (and many scams involve unbonded parties pretending to be someone else). Shippers or brokers who incur losses might sue the perpetrators for damages, but finding and enforcing judgments against criminals who likely operate through shell companies is difficult. Often, victims end up eating the cost or relying on insurance. Cargo insurance (for shippers) may cover stolen goods, but insurers sometimes reject claims if "due diligence" wasn't done (for instance, if the shipper released cargo to a non-authorized carrier). Brokers carry contingent cargo insurance which might cover some theft/fraud events, and errors & omissions insurance which could apply if the broker is accused of negligence in vetting. These policies are a safety net but come with deductibles and claim limits, and too many claims can make premiums skyrocket.

Effectiveness of Prosecution: When fraudsters are caught and prosecuted, it sends a message – but unfortunately, this is relatively rare compared to the volume of fraud. TIA's president lamented in 2024 that the industry is "under siege" and "not getting the support from government and law enforcement" needed. Even when cases are prosecuted, the wheels of justice turn slowly. Meanwhile, fraudsters often move on to new identities or leave the country. One success story is that of repeat offenders being barred from the industry: FMCSA can revoke or refuse carrier/broker authority if they find evidence of involvement in fraud, and they have started doing so in flagrant cases (like revoking the authority of multiple carriers all linked to the same address used in scams). However, given how easy it is to form a new LLC and apply for authority, criminals exploit that loophole. Upcoming regulations may require more vetting of new applicants to prevent immediately re-entering under a new name.

Reporting and Deterrence: Brokers and carriers are encouraged to report fraud incidents to the authorities. The FMCSA's National Consumer Complaint Database (NCCDB) is one avenue to log complaints of broker fraud or cargo theft. While filing a report doesn't guarantee action, it does build the data needed to justify more enforcement. Industry associations like TIA and OOIDA advise their members to report fraud to local law enforcement and FBI quickly – as Brent Hutto of Truckstop warned, one of the biggest mistakes is trying to resolve it privately without notifying others (Battling Cargo Theft and Fraud: How the Freight Industry). Quick reporting can sometimes enable authorities to catch thieves in the act (for instance, if a truck is reported stolen via a fictitious pickup, police might track it if alerted promptly). The reality is that many fraud victims feel the immediate need to solve the problem (e.g., recover goods or pay the carrier) overshadows the pursuit of the criminal, leading to under-reporting. But that trend is changing as the scale grows.

In terms of legal deterrence, the current penalties for freight fraud (if caught) can be severe: wire fraud and identity theft felonies carry potential prison time and fines. The problem is the low probability of being caught has emboldened criminals. This is why industry groups are pushing for stronger enforcement and regulatory oversight – TIA's 2024 report calls for resolving complaints faster, implementing penalties, and closing loopholes that allow these scams. There is also discussion of raising the broker bond amount (to better compensate victims of broker scams) or creating a victim restitution fund, but no concrete action on that yet.

Bottom line: Legal recourse, while available, is perceived as lagging behind the fraud epidemic. Victims often have limited success recovering losses through legal means, and perpetrators exploit jurisdictional gaps. However, with increased awareness, we are seeing momentum in Washington (e.g., fraud task force proposals) and incremental regulatory changes (stricter registration processes, required transparency) that could improve things. Until then, the onus remains on industry stakeholders to protect themselves and each other – essentially preventing fraud so they don't have to rely on after-the-fact remedies. In the next section, we'll explore how rigorous carrier vetting can serve as a frontline defense, and later, how collaboration in the industry is strengthening the collective legal hand by sharing information on bad actors.

Carrier Vetting Methodologies and Their Effectiveness

Robust carrier vetting is one of the most effective defenses a broker or shipper has against freight fraud. By thoroughly screening carriers before tendering loads, brokers can weed out many scammers and reduce the risk of double-brokering, cargo theft, or non-payment. In 2025, vetting methodologies range from old-fashioned phone calls and reference checks to high-tech digital validations. Here we evaluate common vetting practices and how effective they are:

-

Basic Compliance Checks (Authority, Insurance, Safety): At minimum, brokers verify that any carrier they use has an active FMCSA operating authority (MC number), valid insurance, and a decent safety record. This can be done via the FMCSA's SAFER website or licensing portals. Key things to look for include: no recent out-of-service orders, authority status is "Active" and has been active for a certain period, and the carrier's insurance on file meets the requirements (e.g., $1 million liability, $100k cargo, which are standard). Brokers often set internal rules, for example: no carriers with less than 6 months operating history (new authorities carry higher fraud risk, as many scam carriers pop up and disappear in under 6 months), and no carriers with an "Unsatisfactory" safety rating from DOT. Checking insurance certificates is critical – the broker should obtain a Certificate of Insurance (COI) directly from the carrier or their insurer and confirm policy numbers and coverage. An effective method is to call the insurance agent listed on the COI to verify that the policy is genuine and active (fraudsters have been known to forge insurance documents). Basic checks like these catch obvious issues (e.g., someone operating under a revoked authority or expired insurance – a major red flag). They also ensure regulatory compliance. However, on their own, basic checks might not catch a stolen identity (a scammer could be using a perfectly valid MC number of an active, insured carrier that isn't really them). Thus, while necessary, compliance checks are not sufficient alone. That said, they do eliminate the low-hanging fruit of fraud – many con artists won't bother to maintain proper authority or insurance because they intend quick hits and disappear. Effectiveness: High at screening out unqualified carriers, Moderate at stopping sophisticated fraud by impostors.

-

Experience and History Verification: A qualitative but important factor is a carrier's operating history and reputation. Brokers often prefer carriers that have been in business for several years, with a track record of inspections and on-time performance. A carrier with no inspection history is a major red flag – as one guide put it, even small carriers will have some DOT inspections; if a carrier shows zero inspections in SAFER, it could mean the DOT number is dormant or newly reactivated for a scam. Brokers might check the FMCSA SMS (Safety Measurement System) for any data on the carrier: number of inspections, crashes, violations. If a carrier has absolutely no data, extra caution is warranted. Conversely, a history of clean inspections and safe operations is reassuring. Some brokers ask for references or check an informal network – e.g., calling a few known shippers or brokers that have used the carrier to confirm their reliability. While time-consuming, reference checks can reveal if a carrier has had issues like payment disputes or suspected double-brokering in the past. Carrier411 and TIA Watchdog are tools that brokers use to see if other brokers have reported problems with a carrier (like claims of double-brokering or no-shows). A quick search on these platforms can uncover a carrier's dark history if it exists. Overall, verifying that a carrier isn't brand new and has a clean track record is an effective fraud filter. Many scams involve newly created carriers (with no history) or hijacked dormant carriers – both of which would show atypical history on a check. Effectiveness: High at identifying risky newcomers or known bad actors; it leverages industry memory. The trade-off is potentially excluding new, legitimate carriers who simply haven't built history (brokers mitigate this by doing extra vetting on such carriers rather than outright rejecting them).

-

Identity and Contact Confirmation: This step goes beyond documents to confirm you are actually dealing with the real company. Fraudsters often give themselves away with inconsistent details. Brokers should cross-verify the carrier's contact info – the phone numbers, email domain, and address provided – with what's listed on the FMCSA registration or the carrier's official website. If a supposed carrier contacts you from a generic email (like @gmail.com) or a domain that doesn't match their company name, be cautious. Many legitimate small carriers do use public email domains, so this is not a sole disqualifier, but it's a prompt to verify further. One major red flag is if the phone number the carrier provides is different from the one in FMCSA's system or on their insurance paperwork. Scammers often set up a throwaway phone; calling the number on the FMCSA profile can help – if someone else answers or says "that load was stolen" or doesn't know about the load, you've uncovered an impostor. Some brokers will request a copy of the driver's CDL and the truck's license plate at dispatch, then call the carrier's main office to confirm that driver works for them. Modern onboarding platforms (like Highway) facilitate ID verification – they may ask the carrier representative to upload a government ID or even take a selfie to compare against a database. Matching names on contracts, insurance, and FMCSA records is also vital: if the person signing the carrier packet is "John Doe, dispatcher" but FMCSA lists the company owner as someone else, and you can't verify John Doe is employed there, dig deeper. Effectiveness: High for detecting impersonation. Many identity-theft scams fail if any live confirmation is attempted (the fraudster often stops responding when asked for inconvenient verifications). It can be labor-intensive, but newer tech (digital ID checks) is streamlining it.

-

Operational and Capability Vetting: This aspect looks at whether the carrier has the capacity and setup to do what they claim. Fraudulent carriers might be nothing more than a mailbox. Brokers can ask for proof of capability: fleet information (how many trucks/what type), lane experience, even the name of the driver dispatched and truck/trailer numbers. A double broker will fumble on those details or give evasive answers. Some brokers verify the company's physical existence – e.g., using Google Maps to see if the address is a real truck yard or office, or checking the Secretary of State business registration to confirm the company is active and the owners' names match what they were given. ELD data integration can serve here as well: requiring an ELD ping or tracking link from the carrier's truck once a load is accepted. If a carrier cannot comply ("my ELD is broken" or "I don't use tracking"), that's a possible red flag in the age of ubiquitous ELD mandate. Another trick: check if the carrier also has broker authority; if a carrier has both MC (carrier) and MC (broker) authority, there's a risk they might re-broker your load. Some brokers avoid carriers with broker authority for this reason – or at least they scrutinize them to ensure they won't outsource the load. Evaluating a carrier's safety scores (CSA scores for unsafe driving, HOS, etc.) also helps gauge legitimacy; while even scammers can have good scores if they hijack an identity, very poor scores might indicate a carrier that is reckless or not running a compliant operation (which could correlate with willingness to engage in fraud). Effectiveness: Moderate to High – it adds a layer of assurance. Many brokers report that simply asking detailed questions about the carrier's operation will scare off or expose a fraudster. A legitimate carrier will usually gladly provide info and even references; a scammer might push back or give non-answers.

-

Third-Party Vetting Services: As mentioned earlier, many brokers use services like RMIS, TransCore/CarrierWatch, SaferWatch, Highway etc., which package a lot of the above checks into one interface. These services often have their own watchlists and fraud indicators – for example, they might flag if an applicant carrier's bank account is in a person's name instead of a company name (potential sign of scam), or if the IP address used to fill out the carrier packet is from a high-risk region or doesn't match the carrier's home region. Highway, for instance, can flag "identity alerts" if a carrier's profile has been associated with fraudulent activity elsewhere. The effectiveness of third-party services is generally High, as they combine data sources and often stay updated on the latest fraud trends. If one broker reports a carrier as fraudulent in the network, others are warned. The limitation is cost (these are subscription-based) and the fact that ultra-new carriers or new fraud patterns might slip through until data catches up. Nonetheless, using these services dramatically reduces manual workload and catches more inconsistencies than a single person could. It creates a standardized vetting process – which is important as consistency helps ensure no step is skipped on a busy day.

-

Ongoing Monitoring and Re-Vetting: Effective vetting isn't a one-and-done. Brokers that excel in fraud prevention continuously monitor their carrier pool. Many implement a policy to re-vet a carrier if they haven't moved a load in X months (e.g., if a carrier hasn't hauled for you in 6 months, treat them like new – confirm contacts and status again). Some have a 7-day rule for newly onboarded carriers: after approval, if the carrier doesn't take a load within 7 days, they require fresh verification before the first load. This prevents scenarios where a fraudster gets approved, lies in wait, and then months later abuses that access. Monitoring also involves keeping eyes on industry alerts: e.g., if FMCSA issues a warning about a certain fraudulent carrier name that's making the rounds, a good vetting program will cross-check that against their system. Effectiveness: High, as it closes the door that scammers try to exploit over time. It does require having a system or person in charge of compliance follow-ups. Many TMS or onboarding platforms can automate reminders for re-vetting.

In terms of relative effectiveness, layering these methodologies provides the best protection. A carrier that passes all checks (authority, insurance, history, identity verification, etc.) is very unlikely to be fraudulent. In contrast, skipping steps can be costly – brokers who rushed onboarding during the capacity crunch of 2021/22 (when finding any truck was hard) later found that skipping verification led to scams slipping in. As one broker commented, verifying details like phone numbers and email domains now takes more time and "adds complexity to transactions," but it's necessary and worth the slowdown (Battling Cargo Theft and Fraud: How the Freight Industry). Indeed, by late 2024 brokers reported spending significantly more time vetting carriers – checking Secretary of State registrations, confirming email domains, etc. – which does eat into productivity. That trade-off has driven many to adopt the tech solutions we discussed to maintain both speed and security.

To sum up, carrier vetting in 2025 has matured into a multi-step, multi-source process. Effective vetting methodologies combine hard criteria (authority status, insurance, safety ratings) with fraud intelligence (alerts about scams, watchlists) and direct verification (calling, cross-checking identities). Brokers who stick to a strong vetting protocol greatly reduce their exposure to scams. There is no one-size-fits-all – a small broker might manually call references, whereas a large 3PL might lean on integrated software – but the core principles are the same: Know Your Carrier (much like KYC in banking). The next section looks at how the industry is collectively working together to share information and bolster everyone's vetting and fraud-fighting capabilities.

Industry Collaboration and Information-Sharing Initiatives

No single company can combat freight fraud alone; collaboration across the industry and with authorities is essential. In 2024 and early 2025, numerous initiatives and platforms have emerged to facilitate information sharing, collective awareness, and joint action against fraud. These efforts recognize that fraudsters often repeat scams across multiple victims, so spotting and broadcasting their patterns can prevent others from falling prey. Here we outline the key industry collaboration mechanisms and their effectiveness:

-

TIA Watchdog and Fraud Task Force: The Transportation Intermediaries Association (TIA), which represents brokers and 3PLs, operates the TIA Watchdog system – a member-driven platform where brokers can report deceitful or unethical behavior by carriers, shippers, or other brokers. When a broker files a Watchdog report (e.g., a carrier held a load hostage or a double-broker incident), the subject of the report is notified and can respond, and after due process, the report is published for members to see. In 2024, TIA's fraud-reporting service received nearly 1,000 reports (Jan–Aug), with unlawful brokering (double-brokering) accounting for about one-third and identity theft around 17%. This repository of fraud reports is an invaluable heads-up – before doing business with a new partner, a TIA member broker can check if they have any Watchdog complaints. TIA also established a Fraud Task Force in late 2023 comprised of industry executives and tech experts. This task force focuses on education (publishing best practices, webinars), trend analysis, and advocacy. It was instrumental in producing the 2024 "State of Fraud in the Industry" report which quantified the issue and is lobbying for regulatory help. TIA members sharing experiences through committees and conferences has helped spread knowledge of new fraud tactics quickly. The collaborative stance is summed up by TIA's CEO Anne Reinke: "We are an industry under siege… Fraud is a multimillion-dollar issue that demands immediate action" – highlighting that all brokers must band together to address it.

-

CargoNet and NCIB (Insurer-Law Enforcement Collaboration): For cargo theft (which often overlaps with fraud), platforms like Verisk CargoNet and the National Insurance Crime Bureau (NICB) serve as industry clearinghouses for information. CargoNet is a consortium of insurers, carriers, and law enforcement that shares data on cargo theft incidents. When a fictitious pickup or theft occurs, CargoNet can blast out alerts about the commodity, suspects, vehicle descriptions, and MO to its network, increasing the chances of recovery or at least preventing re-use of the same scam elsewhere. They also analyze trends and publish reports that help everyone see the bigger picture (like the annual CargoNet report showing theft hotspots and methods). NICB similarly works with insurance companies and police; it has databases of reported thefts and has helped coordinate multi-agency efforts to bust cargo theft rings. Through NICB, the industry and law enforcement conduct cargo theft task force meetings in heavy-hit states (California, Texas, Florida, Georgia etc.), exchanging intel on active groups and successful tactics. These collaborations have led to recovery of stolen goods and arrests – for instance, NICB noted billions in cargo theft and assists in connecting local police with broader FBI investigations. The benefit to brokers and carriers is an improved flow of info: if a certain fraudulent carrier identity is being used to steal shipments, CargoNet/NICB can disseminate that quickly. Many motor carriers subscribe to CargoNet for this reason – it's essentially an early warning system.

-

Load Board & Tech Company Alliances: The private sector is also collaborating. Load boards and freight tech companies, normally competitors, have recognized the need to join forces on fraud prevention. In 2024, we saw partnerships like Truckstop.com and MercuryGate integrating their systems to leverage each other's strengths in blocking fraud. DAT Solutions (another major load board) acquired smaller tech companies (like Trucker Tools in Dec 2024 (Battling Cargo Theft and Fraud: How the Freight Industry)) to enhance identity verification and tracking capabilities across platforms. Highway has been integrating with multiple TMS and ELD providers to extend its carrier identity network. The idea is to create an interconnected web: if a carrier is flagged as fraudulent on one platform, that information is shared (either formally or informally) so others can act. Even on social media and forums, industry folks have become more active in exposing scams – for example, some broker forums and LinkedIn groups regularly post about new fraud encounters ("watch out for XYZ Logistics, MC# ___, they just double-brokered a load on us"). The sense of "it's about time we protect each other" has been echoed by industry veterans. In one FreightWaves forum, brokers discussed forming an information-sharing consortium not unlike a credit bureau, but for vetting carriers – essentially pooling blacklists and experiences. While a formal universal database isn't here yet, these tech alliances and community efforts are moving in that direction. Brokers increasingly realize that bad actors prey on fragmentation; by uniting, the industry can deny fraudsters the anonymity and gaps they exploit.

-

Freight Fraud Awareness Events: Late 2024 marked the inaugural "Freight Fraud Awareness Day," a campaign to draw attention to the issue and promote cross-sector dialogue (Inaugural Freight Fraud Awareness Day shines light on industry crisis). Orchestrated by industry media and associations, it encouraged companies to hold training sessions and share resources on that day. Additionally, conferences like TIA Capital Ideas and ATA Management Conference have put fraud prevention on the agenda, giving platforms for experts (including FBI agents, prosecutors, and tech CEOs) to speak to audiences of trucking professionals. Such events often result in direct collaboration – e.g., a shipper might team up with their core carriers to develop a joint verification checklist after learning about fraud at a conference.

-

Government and Law Enforcement Collaboration: The public sector is slowly becoming more engaged, often prodded by industry lobbying. The aforementioned Safeguarding Our Supply Chains Act would formalize a multi-agency approach (FBI, DHS, DOT) to freight crime. FMCSA has encouraged the industry to file complaints and share data so that it can justify stronger measures. There is talk of data-sharing agreements where industry groups provide FMCSA or DHS with lists of suspected fraudulent companies to cross-reference with licensing systems, helping to identify patterns (for example, multiple scam carriers using the same address or owner name could be flagged in the registration process). Some states have formed specialized units, like California's CHP Cargo Theft Interdiction Program (CHP CTIP), which coordinate with trucking companies and truck stops to catch thieves. At the national level, the FBI has been reaching out to industry through meetings and asking for input on how fraud is evolving so they can adapt enforcement. These collaborations are nascent but critical, as only with law enforcement's involvement can the highest levels of organized fraud be dismantled.

Overall, information-sharing is improving, though not yet perfect. One challenge is that not all brokers or carriers are part of TIA or subscribe to data networks, so there are blind spots. A very small brokerage might not hear about a common scam until they suffer it. To address this, larger companies and associations are trying to push information outward – e.g., publishing articles, sharing red flag lists (like the one in the next section) publicly, not just behind membership walls. The mantra has become "see something, say something" – if a broker encounters a fraud attempt, informing the community can prevent it from succeeding elsewhere. Industry collaboration creates a network effect: each participant's vigilance contributes to the collective shield. As fraudsters communicate and adapt rapidly among themselves (often via dark web forums or word-of-mouth), the industry must do the same. Initiatives like TIA's task force and CargoNet's intel network indicate that when the industry speaks with a unified voice, it also gains more respect and response from law enforcement and regulators. Combating freight fraud is truly a team sport in 2025.

Practical Fraud Prevention Applications for Brokers and Carriers

Turning theory into practice, this section provides actionable tools and guidelines that brokers (and by extension shippers and carriers) can implement immediately. It includes a step-by-step carrier verification protocol, a checklist of warning signs for operations teams, a framework for evaluating fraud prevention technology, real-world examples of successful programs, and sample policy language to formalize these practices. The aim is to make freight fraud prevention concrete and accessible, balancing technical rigor with day-to-day usability.

Step-by-Step Carrier Verification Protocol

Implementing a standardized carrier onboarding and verification protocol ensures that every new carrier is vetted thoroughly before they haul a load. Below is a step-by-step protocol that a brokerage might use, including template elements to record each step:

-

Carrier Setup Information Collection: Have the carrier complete a Carrier Packet (whether via email or an online portal). This includes collecting their authority information (MC number, USDOT number), insurance certificate, W-9 form, contact information (company address, office and mobile phone numbers, emails), and references. Template tip: Use a standardized carrier setup form that has fields for all required info and checkboxes for each document received. Ensure the form has a signature section where the carrier attests that all information is accurate and authorizes you to verify it.

-

FMCSA Authority and Safety Verification: Immediately verify the carrier's credentials on the FMCSA website (SAFER or Licensing & Insurance). Confirm the MC# status is Active (and not suspended or revoked) and note the carrier's operating years. Check the DOT safety rating (Satisfactory/Conditional/Unsatisfactory) and note if any Operating Authority History shows recent changes (e.g., if the authority was just granted last week, that's important to know). Template: Record the DOT# and MC#, the status, safety rating, and years in business on a checklist. For example: "Authority active? Yes – since 2018; Safety Rating: Satisfactory (as of 2022)." If anything is amiss (e.g., "Authority granted 2 days ago"), highlight it for management review.

-

Insurance Verification: Examine the Certificate of Insurance provided. Verify that it lists adequate coverage (at least $1,000,000 auto liability and $100,000 cargo, as per industry norm). Confirm the policy effective dates. Then call the insurance agency or use their online certificate verification (many large insurers have hotlines) to ensure the policy is real and currently in force. Also verify that the insured name on the policy exactly matches the carrier's legal name or DBA. Template: On the checklist, have fields: "Insurer Name; Agent Contact; Liability $; Cargo $; Expiry Date; Verified with agent: Yes/No (initials of verifier)." Don't skip directly calling if anything seems off (like typos or oddly low coverage amounts).

-

Identity and Contact Confirmation: Independently confirm the carrier's business identity. Look up the company's phone number from an authoritative source (FMCSA site or their official website if one exists) and call it. When you reach them, ask for the person who submitted the packet to you, or ask to verify that that person is an employee. This ensures you didn't just communicate only with a potential scammer via their provided contact. Also, do a quick email domain check: if the email is @somecarrier.com, browse to that domain and see if it's a legitimate website for the carrier; if it's a public email (@gmail, @yahoo), ask if they have a company email or why not. Request a copy of the driver's license (ID) of the person signing the contract – some brokers now include this in onboarding to have an identity on file. You can cross-check the name and address on the ID with the company's info (for example, if the person signing is an owner-operator, the addresses might match). Template: You can have a section "Identity Verified by:" with checkboxes: Called official phone, Email domain matches company ( /⚠️ if not), Driver/rep ID received, ID name matches company rep. Any discrepancies get escalated to a manager.

-

References and Reputation Check: If the carrier is new or unknown, ask for references – at least one shipper or broker they've worked with. A quick call or email to that reference can confirm the carrier's service and honesty. Additionally, search industry databases or forums for the carrier's name and MC number. Check TIA Watchdog (if a member) for any reports on them. If you have access to Carrier411 or similar, review any notes or reports. Even a general Google search of the carrier's name with keywords like "scam" or "fraud" sometimes surfaces stories. Many carriers will have no hits (which is good). If you find negative reports or unresolved issues (e.g., "Carrier X – multiple claims of double brokering"), that's likely grounds to reject them. Template: On your form, include: "References checked: (list names) – Outcome OK? Y/N. Watchdog/Carrier411 checked: Y/N – Notes: **__**."

-

Operational Fit and Trial Load: Verify some operational details to ensure the carrier is a fit and not a front. Ask how many trucks they operate and in what regions. If the current load is, say, Los Angeles to Dallas, and the carrier is based in Florida with no history in CA, ask how they're handling it (maybe they have trucks all over, but ask). For asset-based carriers, you might request the truck and trailer numbers assigned to the load and possibly the driver's name at dispatch. Note these down. If your company policy is cautious, consider giving a first load that is low-risk (maybe not your highest value shipment) to new carriers as a trial. Monitor that load closely (with tracking). Template: Have a "Dispatch info received" line: Driver __ / Truck # __ / Trailer # __. If possible, verify one of those pieces (some brokers cross-check the truck number with the one on the carrier's insurance policy or ELD ping). Also include a management sign-off: "Approved for 1st load by __ (name/date).

-

Contractual Agreements and Security Measures: Ensure the carrier signs your Broker-Carrier Agreement which includes clauses forbidding re-brokering of loads without permission, requiring them to be the ones hauling, and compliance with all laws. Include in the contract or as an addendum a clause like "Carrier agrees that all information provided is true, and any misrepresentation is grounds for immediate termination of contract and possible legal action." If you use a platform like Highway or RMIS, by the time the carrier completes onboarding, much of this is documented digitally. Once all the above checks are passed, activate the carrier in your system so dispatchers know they're cleared to use. Template: Final checklist item: "Broker-Carrier contract signed and on file. Entered into TMS by __ (initials)."

By following a protocol like this, consistently, your team creates a paper trail of due diligence and significantly lowers the chance of onboarding a fraudulent carrier. The protocol can be adjusted based on risk tolerance – for instance, a long-time carrier with hundreds of inspections may not need reference calls – but new entrants and any red-flag cases should go through every step. The key is to make no exceptions in the process: scammers often try to rush or pressure brokers into skipping steps ("We can pick up in 1 hour, just send the rate confirmation quickly"). A documented process gives your staff a reason to say "Sorry, we have to complete our setup steps first." Most legitimate carriers understand and even appreciate a thorough vetting (it keeps the bad actors out, which benefits them too). In Appendix or supplemental materials, you might keep template forms as mentioned (Carrier setup form, vetting checklist, script for verification calls) – these can be reused for each new carrier.

Red Flag Checklist for Fraud Detection

Training operations and dispatch teams to spot warning signs is crucial. Below is a checklist of red flags that could signal freight fraud or a problematic carrier/broker situation. If any of these are observed, the team should pause and investigate further before proceeding:

-

Carrier's name not on the Bill of Lading (BOL): By law, the carrier hauling the load should be named on the BOL. If you're a driver and the broker's name or an unknown third party's name is on the BOL instead of yours, it's a red flag for a double-brokered load. For brokers/shippers, if the documents at pickup don't list the carrier you hired, something is wrong – it could mean the load was handed off without permission.

-

Offer rates are far above or below market: Fraudulent intermediaries often lure victims by offering an unusually high rate to carriers (so carriers bite on a re-posted load) or by bidding a very low rate to shippers/brokers (to win a contract they intend to double-broker or steal). If a rate seems too good to be true, it probably is. For brokers, if a carrier is willing to run a load way below normal cost, verify they aren't expecting to hand it off to someone else.

-

New or No History Carrier with No Inspections: A carrier that just got its authority days ago, or one that shows zero inspection or safety history, warrants extreme caution. While everyone starts somewhere, the combination of new authority + high pressure for a load is suspect. Many fraud rings use fresh MC numbers repeatedly. Lack of any CSA data is a telltale sign – even a 1-truck operation usually has at least one inspection in the past year.

-

Contact information discrepancies: Mismatched phone numbers, emails, or bank details are a top red flag. For example, if a carrier's FMCSA profile shows a Wisconsin phone number but the person calling you has a California number and can't explain the difference. Or if the carrier's email domain doesn't match their company (e.g., official docs say @ABCTrucking.com but emails come from @XYZlogistics.com). Also, if a broker's info on file with FMCSA doesn't check out (address is a P.O. box, phone is always an answering service, etc.) (3 red flags that could signal a double-brokerage scheme | Trucking Dive), be wary.

-

Frequent request for fuel advances or unusual payment terms: If a carrier (especially one you haven't worked with) immediately asks for a fuel advance or quick pay before even picking up, treat with caution. Fuel advances are normal in some cases, but scammers exploit them. Similarly, if a new carrier insists on using an unfamiliar payment portal or asks the broker to pay a third party, that's a red flag. A fake carrier might request an advance and then ghost, or a fake broker might ask a shipper to prepay for "expedited services".

-

Changes in instructions via email-only communications: Be cautious if you receive an email changing critical information (payment instructions, pickup location, etc.), especially if it wasn't confirmed by a phone call. Fraudsters often use email spoofing to impersonate partners. For example, an email that looks like it's from your customer saying "we changed the pickup address, send the driver here instead" could be a trap (shipment diversion attempt). Always verify such changes through a known contact on the phone or a secondary channel.

-

Carrier or broker cannot be reached by official channels: If you can only reach the contact on a cell phone and the main office line always goes to voicemail or is disconnected, that's a concern. Reputable carriers and brokers have working official lines. If a carrier gives excuses like "our office phones are down" or they never answer during normal business hours, question it. Lack of a web presence can also be a soft flag – many legitimate small carriers might not have a big website, but in the digital age most have some footprint (even a Facebook page). A complete absence might warrant deeper vetting.

-

Inconsistent stories or knowledge gaps: When talking with the carrier or broker, do they seem to actually know the business details? For instance, if a "carrier" can't answer routine questions about their fleet or talks in circles when you ask about their safety rating or previous loads, they may not be a real carrier. Similarly, if a dispatcher doesn't know the driver's name or truck number immediately, that's suspicious. Consistency is key – any hesitancy or contradiction (e.g., one day they say "our truck" and later slip that they "gave it to another driver") should raise an eyebrow.

-

"Paperwork issues" at pickup or delivery: If a driver shows up and asks the shipper to change the carrier name on the BOL or presents a BOL with whited-out sections, that's a red alert. Also, if at delivery a different carrier name is on paperwork than expected, it indicates the load was likely handed off improperly. A hostage load scenario often starts with a driver arriving whose company isn't what the broker told the shipper; that confusion can precede a demand for additional payment. Any document irregularity (missing signatures, altered dates, etc.) should be treated seriously.

Operations teams should keep this checklist handy (as a poster on the wall or a reference card). If one or more of these red flags appear, stop and escalate. It doesn't always mean a deal is fraudulent, but it does mean extra verification is needed. Having a policy like "if two or more red flags, get manager approval before proceeding" can be wise. Many fraud incidents have later been dissected to reveal multiple red flags that, if noticed in time, could have prevented loss. Training staff to be fraud-aware and empowering them to question and verify (even if it delays a load) will cultivate a more secure operation.

Technology Evaluation Framework for Fraud Prevention Solutions

With numerous tools and platforms available to combat freight fraud, brokers and carriers need a framework to evaluate which solutions best fit their needs. Below is a set of criteria and considerations to use when assessing fraud prevention technologies (e.g., carrier onboarding services, tracking systems, AI risk detection software):

-

Coverage and Data Quality: Evaluate what data sources the solution draws on and its breadth of coverage. For instance, a carrier vetting tool that covers 98% of active carriers (like RMIS claims) will likely reduce blind spots. Check if the tool has integration with FMCSA data (authority status), insurance databases, watchlists (TIA Watchdog, CargoNet, etc.), and if it updates frequently. The quality of fraud detection is only as good as the data behind it. Questions to ask: Does it flag new DOT registrations or identity changes? Does it incorporate user-reported fraud incidents in real time? A solution with an extensive, current database of "bad actors" and suspicious patterns provides stronger protection.

-

Functionality and Features: Identify the specific features relevant to your operation. Key features might include: automated carrier onboarding (online packets, e-signature, instant verification), real-time alerts (e.g., if a carrier's insurance cancels mid-trip), ELD/GPS tracking integration, multi-factor authentication for logins, document validation (like OCR to catch mismatched names on insurance forms), and analytics/dashboard that score or rank risk. If evaluating AI-driven systems, ask for examples of the types of fraud indicators it flags (low rate anomalies, duplicate bank accounts between different carriers, etc.). Make sure the solution addresses your main pain points – for example, if identity theft is your top concern, then ELD identity lock-in or ID verification features are crucial. If payments fraud worries you, perhaps a platform that secures payment info is needed.

-

Integration and Workflow: A great fraud tool should integrate smoothly with your existing workflow (TMS, load boards, dispatch process) rather than adding cumbersome steps. Check what integrations or API the solution offers – can it plug into your TMS so that, say, when you create a load, it automatically checks the carrier? Or does it require using a separate portal? Look for TMS partnerships (e.g., MercuryGate + Truckstop integration shows a focus on workflow efficiency). If you use certain ELD providers, see if the fraud solution integrates with those for tracking and verification. Also consider user experience: is it easy for your team to learn and for carriers to comply with (for onboarding portals)? Some tools offer mobile apps or portals for carriers to simplify document upload and tracking – which can speed adoption.

-

Speed and Performance: Time is critical in freight. Determine how quickly the solution can perform its checks or alerts. For example, can it vet a new carrier in minutes (as some claim) or does it take hours? Does it operate 24/7 with automated processes? If an AI system flags something at 2 AM, will it notify you immediately? During a demo, pay attention to response times – if you input a carrier's MC, how fast do you get a risk report? Additionally, check capacity: can it handle volume if you need to vet dozens of carriers quickly during a surge? The best solutions offer near-instant feedback for common checks, ensuring security doesn't bottleneck operations.

-

Accuracy and False Positives: Fraud prevention is a balance – you want to catch the bad guys without wrongly sidelining good partners. Ask the provider about their false positive rate and if possible, seek user feedback or case studies. Does the AI flag so many edge cases that your team will end up chasing ghosts? Look for features that allow tuning risk thresholds to your tolerance. For example, maybe you can set it to only flag carriers under 30 days authority as opposed to 90 days, depending on how strict you want to be. Check if the system provides context with alerts – e.g., instead of just "flagged carrier," it says "Flagged: insurance policy number mismatch" or "Address used by 3 other carriers." This helps your team quickly assess validity of an alert. A trial period or pilot can be very useful to gauge accuracy in your real scenarios.

-