Blog

15 Carrier Sales Strategies for Freight Brokers in 2025

Master the 15 most effective carrier sales strategies for freight brokers in 2025, from lane-specific targeting to AI-powered automation. Learn how top performers use data-driven negotiation, strategic rate publishing, and relationship-building to move 2-3× more freight.

Choosing a Freight TMS System: The Definitive Guide for Brokers (2025)

When choosing a freight TMS system, first define your operational requirements, evaluate vendors against these criteria, and ensure the system offers essential functionality with room to grow. With costs ranging from $100-1,500 per user monthly, the right TMS integrates with your existing tools and delivers clear ROI through efficiency gains.

Co-Brokering vs Double Brokering: Legal Collaboration vs Criminal Fraud

Co-brokering is legal collaboration between licensed brokers with transparency, while double brokering is illegal fraud where carriers re-broker loads without authority. Learn how to identify each practice, implement proper documentation, and protect your brokerage from fraud.

Digital Freight Matching Guide: How It Works & Why It Matters for Brokers

Digital freight matching uses AI algorithms to automatically connect brokers with carriers based on load characteristics, reducing sourcing time from hours to minutes. This comprehensive guide explains how modern DFM platforms work, their benefits, implementation strategies, and future trends.

EDI Integration Benefits for Freight Brokers: Complete ROI Analysis & Implementation Guide

EDI integration delivers 287% ROI for freight brokers, saving $12-17 per transaction and reducing processing time from 45 to under 5 minutes per shipment. While implementation costs range from $5,000-25,000 plus monthly fees, most brokers achieve full ROI within 4-7 months.

Freight Broker Customer Retention: 10 Strategies That Actually Work

Customer retention costs 5-7x less than acquisition for freight brokers, yet most lose 30-40% of shippers annually. Learn 10 proven strategies – from proactive communication protocols to specialized account management – that help top brokers maintain 80%+ retention rates and significantly higher profits.

Freight Market Cycles Explained: A Broker's Survival Guide

Freight market cycles occur in 2-3 year periods with four phases:Trough, Recovery, Peak, and Collapse. Learn how to identify cycle position through key indicators and implement specific broker strategies for each phase to maintain profitability regardless of market conditions.

How to Optimize Agricultural Equipment Shipping: A Comprehensive Guide for Brokers

Agricultural equipment shipping requires specialized trailers, proper permits, strategic route planning, and seasonal coordination. Learn proven optimization strategies for moving oversized farm machinery while reducing costs and delays.

Parade Review: Features, Pricing & Limitations (2025)

Parade capacity management platform costs $500-1,500 monthly, excelling at carrier database organization and automated matching but lacking verification capabilities and complete automation. Best for mid-sized brokers with existing carrier networks seeking better relationship management.

Top Challenges Cosmetics Shippers Face: Solutions for Freight Brokers

Discover how freight brokers can overcome the seven major challenges in cosmetics shipping:temperature control, fragility, security, regulations, sustainability, seasonal demand, and specialized packaging.

Co-Broker Agreement: Complete Template & Guide for Freight Brokers

A comprehensive co-broker agreement protects freight brokers when collaborating on shipments. This guide provides a complete template covering commission structure, payment terms, carrier selection responsibilities, and non-solicitation clauses—all vital for preventing disputes and legal issues.

10-Point Freight Broker Sales Pitch: A Simple Guide That Actually Works

A great freight broker sales pitch takes just 2 minutes:introduce yourself concisely, demonstrate industry knowledge, offer a clear value proposition with evidence, and end with a specific next step. This 10-point guide shows exactly how to create and deliver a pitch that converts.

149 Freight Industry Statistics: The Ultimate Data Collection (2025)

Explore 149 essential freight industry statistics covering market size, broker profits, carrier data, technology trends, and more in this comprehensive 2025 data collection.

Freight Brokerage Industry Analysis: Market Trends & Outlook (2025)

Comprehensive analysis of the freight brokerage industry covering market size, profit margins, regulatory landscape, and key trends shaping the sector in 2025.

Best Load Boards for Freight Brokers in 2025: DAT vs Truckstop vs TruckSmarter

DAT leads with the largest network but highest cost ($625-$1,200/month), Truckstop.com excels for flatbed freight at midrange prices ($450-$900/month), and TruckSmarter offers a completely free alternative with a growing user base. Most successful brokers use multiple load boards rather than just one.

How to Become a Freight Broker in 2025: The No-BS Guide

Learn how to become a freight broker with this comprehensive guide covering licensing, startup costs, training, and essential steps from a 30-year industry veteran.

How to Become a Freight Broker Without a College Degree

Yes, you can become a successful freight broker without a college degree. This guide covers the skills that actually matter, alternative education paths, and step-by-step instructions from a 30-year industry veteran.

Best Freight Broker Training Programs: Complete 2025 Comparison & Cost Guide

The best freight broker training programs for 2025 include TIA ($1,045-$1,595), Brooke Transportation ($1,500-$2,500), DAT Academy ($995-$1,795), LDI ($1,295-$2,200), and Freight Broker Boot Camp ($495-$995). This comprehensive guide compares curriculum, formats, and which programs actually deliver ROI.

How to Become a Freight Broker with No Experience: The Complete 2025 Guide

Learn how to become a freight broker with no experience through structured training, certification, mentorship, and strategic networking. This comprehensive guide covers licensing requirements, essential skills, and growth pathways into the $94.7 billion industry.

The Definitive Freight Fraud Report: A Comprehensive Analysis of Schemes, Impacts, and Countermeasures (2025)

Comprehensive analysis of freight fraud in 2025, examining current schemes, financial impacts, prevention technologies, and best practices for brokers and carriers to protect their businesses.

Preventing Cargo Theft in High-Risk Lanes: A Freight Broker's Guide

Preventing cargo theft in high-risk lanes requires layered security:advanced carrier vetting, real-time tracking, strategic routing, and regular check calls. Learn the current hotspots and proven prevention strategies for freight brokers.

Freight Fraud Prevention Strategies: The Complete Guide for 2025

Protect your brokerage with five essential fraud prevention strategies:AI-powered carrier verification, secure digital infrastructure, rigorous documentation, payment security protocols, and strategic intelligence sharing—all proven to reduce fraud incidents by up to 87%.

Carrier Vetting Guide for Freight Brokers: Process, Tools & Best Practices

Carrier vetting combines authority verification, insurance validation, safety checks, and fraud screening to protect brokerages. This comprehensive guide covers the complete process, best practices, and how technology can reduce vetting time by 85% while improving fraud detection.

The Freight Broker Technology Guide: Essential Tools for Success in 2025

The definitive guide to freight broker technology in 2025, covering essential systems, AI automation, implementation strategies, and ROI analysis. Learn how modern brokers use technology to manage 2-3× more loads with the same team size.

Freight Broker Pay: Actual Salary Ranges & Commission Structures (2025)

Freight brokers earn $45,000-$400,000 annually, with most making $65,000-$150,000. This comprehensive guide breaks down salary ranges by experience level, common commission structures, and strategies to increase your earnings.

Carrier411 Review: Pros, Cons & Top Alternatives in 2025

Carrier411 provides basic verification but lags behind 2025 alternatives in fraud detection and automation. While solid for document storage, newer platforms like Foreigh deliver 85% faster verification and catch 3x more fraud with real-time monitoring.

6 Essential Freight Broker Contracts: Complete Guide with Templates

The 6 essential freight broker contracts include Broker-Carrier Agreements, Load Confirmations, Rate Confirmations, Accessorials, BOLs, and Carrier of Choice contracts. This comprehensive guide includes templates, example language, and best practices for effective contract management.

10 Proven Carrier Relations Strategies for Freight Brokers in 2025

The top freight brokers achieve 80%+ carrier retention by implementing 10 proven carrier relations strategies:fair pricing, consistent freight, reliable payment, personalized relationships, operational support, accurate information, recognition programs, technology integration, feedback systems, and carrier development opportunities.

Carrier Locator 2025: Advanced Tools for Finding & Vetting Qualified Carriers

Modern carrier locator tools combine AI verification, comprehensive databases, and automation to help freight brokers find qualified carriers in minutes. Learn how 2025's advanced solutions reduce sourcing time by 80% while preventing fraud.

Freight Broker Business Plan: A Complete Guide for 2025

A complete freight broker business plan requires 9 essential components from executive summary to financial projections. Learn exactly what to include in each section, startup prerequisites, and how to create financial projections that reflect industry benchmarks.

SmartBroker: The 2025 Evolution of Freight Brokerage (and How to Become One)

A SmartBroker combines advanced technology with human expertise to move twice the freight with higher margins. Learn the essential components, implementation roadmap, and measurable benefits of becoming a modern freight broker in 2025.

Best CRM for Freight Brokers: What Actually Works in 2025

The best CRM for freight brokers depends on size:Salesforce for large operations, FreightPath for mid-sized brokers, and Pipedrive for small teams. What truly matters isn't fancy features but dual relationship management, TMS integration, and workflow automation that addresses freight-specific needs.

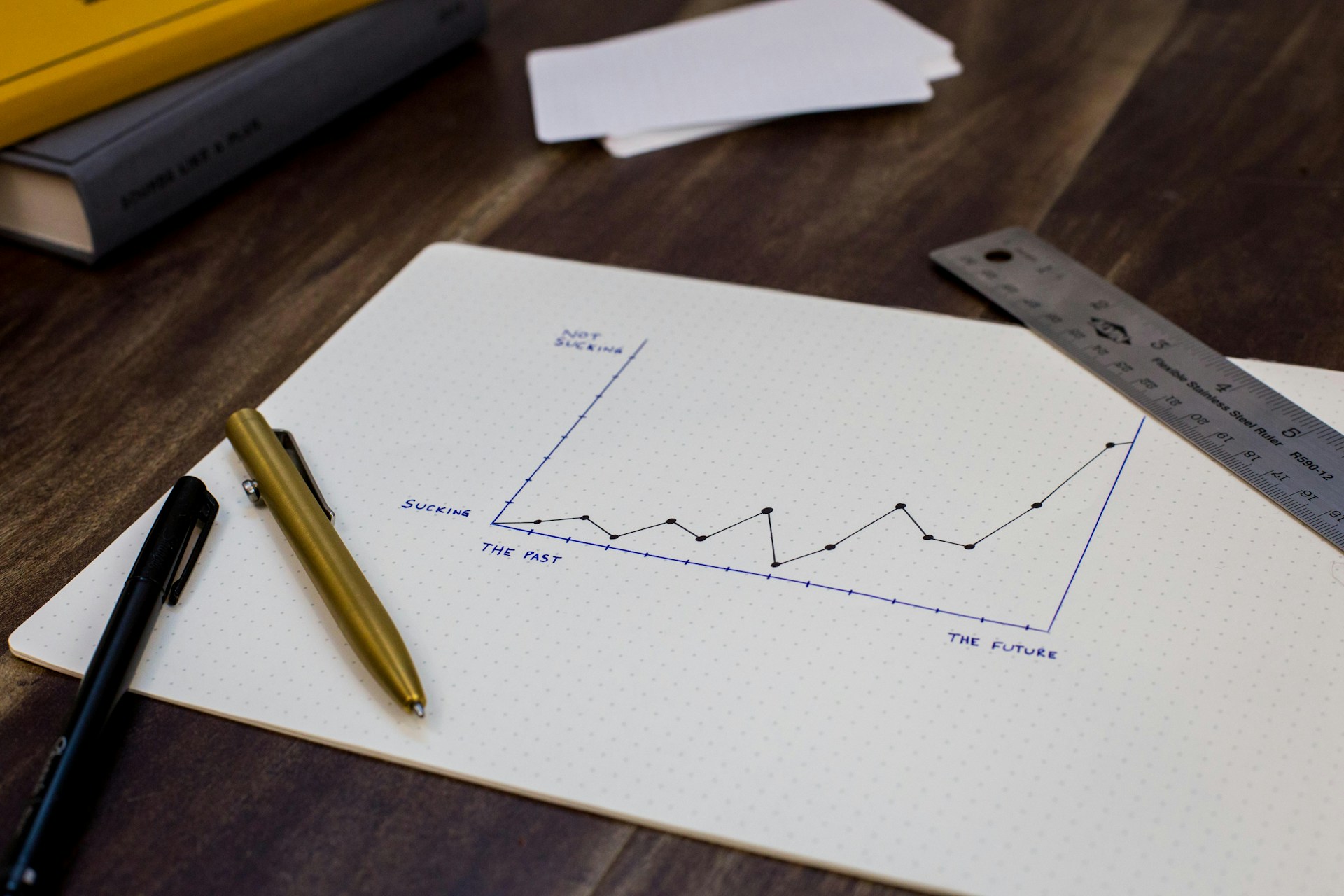

Should You Start a Freight Broker Business in A Down Market?

Starting a freight broker business in a down market is viable with the right approach—technology adoption, niche specialization, and minimal overhead can lead to profitability in as little as 30-45 days instead of the traditional 6-12 months.

AscendTMS Review: Features, Pricing & Limitations for Freight Brokers

AscendTMS offers an accessible cloud-based TMS with minimal onboarding costs. While ideal for small brokers needing basic functionality, it lacks the sophisticated automation tools that larger operations require for scaling beyond 100-150 daily loads.

8 Proven Strategies to Reduce Customer Acquisition Costs for Freight Brokers

The average freight broker spends $900-$1,500 to acquire a new shipper client. Learn 8 proven strategies to reduce these costs by 30-45% while increasing conversion rates—from sales process optimization to technology implementation and strategic content marketing.

Freight Broker Liability Court Cases: Key Precedents & Protection Strategies

Learn the key freight broker liability court cases that have resulted in multimillion-dollar verdicts and the specific protection strategies brokers need to implement in 2025, including verification protocols, documentation standards, and contract provisions.

AI in Logistics: How Freight Brokers Are Revolutionizing Operations in 2025

AI has transformed freight brokerage by automating carrier sourcing, rate negotiation, document processing, and load tracking. The technology enables brokers to manage 35-50 loads weekly versus 15-20 pre-AI, delivering positive ROI within 45-90 days.

Shipper Relations Best Practices: The Complete Guide for Freight Brokers

Successful shipper relations require five core practices:proactive weekly communication, transparent pricing, dedicated account management, data-driven reporting, and 15-minute problem response times. Brokers implementing these strategies achieve 85-90% shipper retention versus the industry average of 60-65%.

How AI is Transforming Freight Security in 2025

AI is revolutionizing freight security by detecting fraud patterns, monitoring real-time threats, and predicting high-risk movements. Learn how brokers are implementing these technologies to reduce risk exposure by 60-80%, saving an average of $75,000 annually in prevented fraud.

Autonomous Procurement in Freight Brokerage: How It Works and Why It Matters

Autonomous procurement uses AI to automatically source carriers, negotiate rates, and book capacity with 70-85% less time. Learn how these systems work, their ROI, and implementation strategies for freight brokers seeking to scale operations without proportionally increasing headcount.

Quote Factory Review: Features, Pricing & Limitations (2025)

Quote Factory TMS offers strong LTL quoting and document management, priced at $150-$400 per user monthly. While effective for shipment execution, it lacks the advanced carrier sales automation most brokers need to scale operations without adding headcount.

Freight Brokerage Software: Complete Guide to Options, Costs & Features (2025)

Compare the best freight brokerage software of 2025 with detailed pricing ($100-1,500/user/month), features, and ROI analysis. This guide covers enterprise solutions like McLeod, mid-market options like AscendTMS, and AI-powered platforms that automate carrier sourcing and negotiation.

What Makes the Best Truck Load Brokers in 2025: Strategy Analysis & Benchmarks

The best truck load brokers maintain 75%+ carrier retention rates, move 35-50 loads weekly per rep, and leverage AI-powered systems that reduce negotiation time by 70%. Learn the 7 key strategies that separate elite brokerages from average performers.

Freight Procurement Automation in 2025: AI Tools That Actually Work

AI-powered freight procurement tools reduce carrier sourcing time by 65-80% while increasing capacity by 30-45% without adding headcount. Learn which AI tools actually work for brokers in 2025.

Carrier Onboarding for Freight Brokers: The Complete Guide (2025)

Carrier onboarding takes 35-45 minutes per carrier and requires 8 essential steps from verification to monitoring. This guide covers the complete process, documentation red flags, verification sources, and how automation can reduce onboarding time by 70-85%.

Shipper Freight: How Brokers Can Secure and Maximize Direct Business

Shipper-direct freight delivers 2-3× higher margins (15-25%) than load board or co-brokered freight. This guide shows brokers how to secure, manage and grow valuable shipper relationships through targeted prospecting, exceptional service, and strategic technology implementation.

Broker Carrier Summit: Guide to Top Events & Maximizing Value in 2025

Broker carrier summits offer 10-20× ROI through relationship building. Learn about the top 2025 events, effective preparation strategies, and follow-up techniques that convert connections into valuable partnerships.

Lumper Fees: Complete Guide to Current Rates & Payment Methods (2025)

Lumper fees typically range from $150-$450 per load in 2025, with significant regional variation. This guide provides current rates for 50 metro areas, payment methods, and strategies for freight brokers to manage these third-party unloading charges efficiently.

TMS Integration for Freight Brokers: The Comprehensive Guide to Connected Systems

TMS integration connects your freight brokerage systems, increasing productivity by 20-35% and reducing errors by up to 90%. This comprehensive guide covers critical integrations, implementation strategies, and a complete list of compatible software.

Freight Broker Prospecting: The Complete System for Getting Loads from Shippers

Learn the complete system for freight broker prospecting with proven strategies for identifying target shippers, multi-channel outreach, and value-based pitching that converts. Includes templates, metrics, and daily routines used by successful brokers.

TIA Watchdog vs. Modern Carrier Verification: A 2025 Comparison

TIA Watchdog relies on historical reported incidents, while modern carrier verification systems like Foreigh use real-time data and AI to proactively identify high-risk carriers before problems occur. Learn the key differences and why most brokers now need both approaches.

Complete Guide to Accessorial Charges for Freight Brokers: Current Rates & Management Strategies

Learn current market rates for accessorial charges in freight brokerage and strategies to manage them. Complete guide to detention, stop-offs, lumpers, and more with 2025 pricing data.

TONU Fees Explained: Standard Rates, When to Pay, and How to Avoid Them

TONU (Truck Ordered Not Used) fees typically cost $150-200 when loads cancel after carrier confirmation. Learn when to pay, how to negotiate, and strategies to prevent these charges with this comprehensive broker's guide.

The Perfect Freight Broker Cold Email Template: 10 Sentences That Convert

This 10-sentence freight broker cold email template consistently converts prospects into customers. Learn exactly why each element works with a breakdown of the subject line, body paragraphs, and professional footer.

BASIC Scores for Carriers: What Freight Brokers Need to Know in 2025

BASIC scores are critical carrier safety metrics in 7 categories that help freight brokers identify high-risk carriers. Learn how to access, interpret, and use these percentile rankings to protect your brokerage from liability.

Why Freight Brokers Should Target Niches (And 20 Profitable Ones to Consider)

The most successful freight brokers specialize in niches. Discover why targeting specific markets works and explore 20 profitable equipment and industry niches worth considering.

Freight Broker License: Complete Guide to Requirements, Costs & Application Process

Learn how to get a freight broker license in 2025 with this comprehensive guide covering requirements, costs, application steps, and insider tips from a 30-year industry veteran.

Automation for Carrier Sales in 2025: How Top Brokers Move Twice the Freight

Automation has transformed carrier sales for freight brokers in 2025, enabling faster carrier sourcing, automated verification, and intelligent negotiation. Learn how top brokers now move twice the freight with the same team size.

Freight Broker Surety Bond with Bad Credit: Costs & Options (2025)

Getting a freight broker bond with bad credit costs $4,875-$12,500 annually versus $750-$1,500 with good credit. Learn complete broker startup costs, credit-based options, and strategies to reduce expenses.

Trucker Tools Review: Features, Pricing, and Alternatives (2025)

A comprehensive Trucker Tools review analyzing its features, pricing, and limitations compared to modern alternatives, based on 8+ years of industry experience using the platform.

How Much Does a Freight Broker Charge Per Load in 2025

Freight brokers typically charge 10-18% of load value in 2025 ($200-$450 per load). Learn the pros and cons of rate per mile, rate per pound, and flat rate pricing models with current market rates.

10 Essential Items Every Carrier Packet Should Include in 2025

A complete carrier packet requires 10 essential items including authority verification, insurance certificates, and legal agreements. Learn what brokers should demand from carriers to minimize risk and speed up onboarding.

How Long Does It Take to Get a Freight Broker License?

Getting a freight broker license takes 4-6 weeks for FMCSA processing, but the complete process from preparation to being operational typically takes 3-6 months.

Double Brokering: What It Is, Risks, and How to Protect Your Business

Double brokering occurs when carriers illegally re-broker your loads without permission, creating serious liability risks for brokers. Learn how to identify and prevent it.

The Digital Freight Brokerage Market in 2025: AI Revolution & What Comes Next

The digital freight brokerage market is set to reach $59.8B by 2027. Learn why carrier sales automation delivers the fastest ROI and how to implement AI in your brokerage to stay competitive.

Supply Chain Management Systems for Freight Brokers: A 2025 Guide

A comprehensive guide to supply chain management systems for freight brokers in 2025, focusing on TMS solutions, integration capabilities, and specialized tools to maximize operational efficiency.

Carrier Sales Automation Tools for Digital Freight Brokers in 2025

Carrier sales automation tools enable digital freight brokers to move twice the freight without adding headcount. Learn how pricing automation, AI-powered emails, and intelligent negotiation systems transform brokerage productivity.

How Do Brokers Get Loads From Shippers? 8 Proven Methods in 2025

Freight brokers get loads from shippers through eight proven methods: cold calling, networking, referrals, digital marketing, load boards, strategic partnerships, freight marketplaces, and niche specialization. This guide covers effective strategies for each approach.

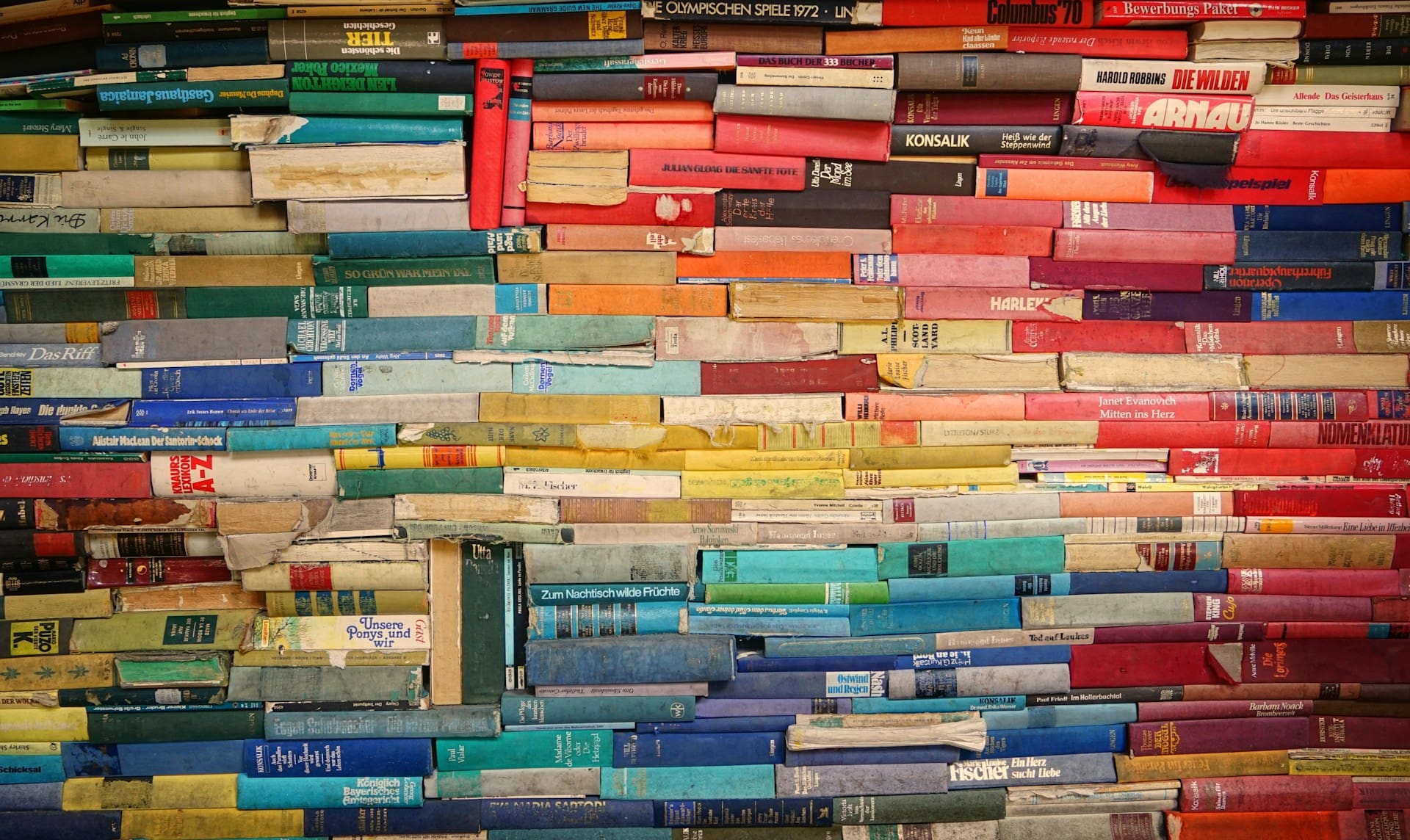

5 Must-Read Books for Freight Brokers in 2025

Discover the 5 essential books every freight broker should read in 2025 to improve their business strategy, leadership skills, and operational effectiveness in today's complex logistics landscape.